The Cost of Tariffs On Your Office Furniture Project in 2026

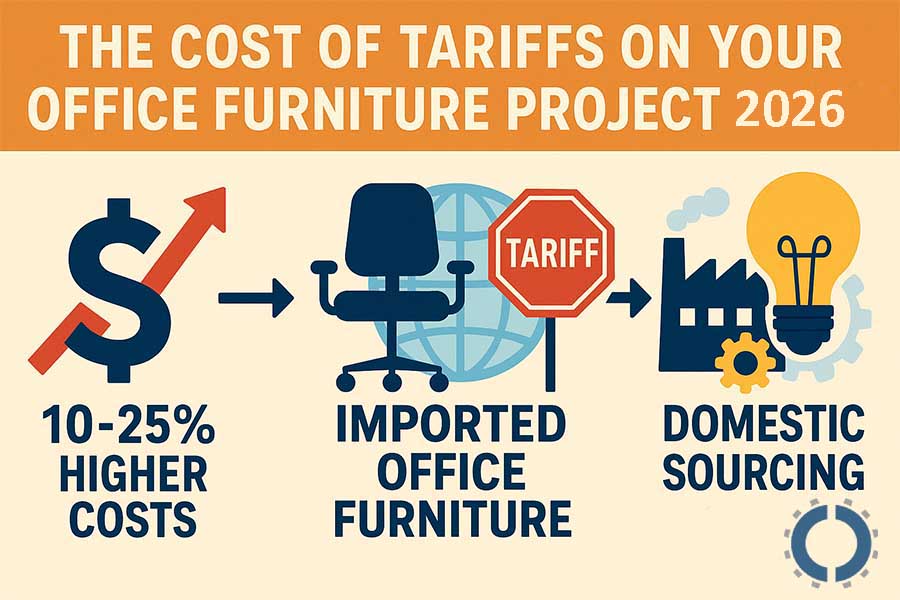

In this turbulent and changing global market, the impact of tariffs on your office furniture projects in 2026 is a serious and completely natural concern.

In 2026, tariffs on imported office furniture—especially from countries such as China—can increase project costs by 10–25%, depending on the material and origin. To reduce impact, consider sourcing from domestic manufacturers or using tariff-exempt trade agreements.

The goal of this article is to clearly show you exactly where these costs come from and how they impact your project budget and schedule.

In this guide, we won’t just cover the direct costs of tariffs, but we’ll also examine the hidden costs and, most importantly, introduce practical and smart strategies to help you overcome these challenges and successfully complete your project.

What are Tariffs?

A tariff on Houston office furniture is a type of tax that governments impose on imported (and sometimes exported) goods.

The main purpose of imposing tariffs can be one or more of the following:

- Supporting domestic producers: By making foreign goods more expensive, domestic products are given the opportunity to compete.

- Generating revenue for the government: Tariffs are an indirect source of tax revenue for government budgets.

- Political or commercial pressure: Sometimes countries impose punitive tariffs to pressure economic competitors or respond to hostile policies.

Key Tariffs and Trade Policies in 2026

In 2026, the United States implemented a new set of broad the cost of tariffs on office furniture, known as “Universal Tariffs.”

Some of their features include:

- Applying a base tariff of 10% on most goods imported from competitor countries.

- Higher tariffs (up to 25%, 35% or even 50%) on specific goods such as metals, industrial parts, and furniture.

- Some goods include exemptions or zero rates for strategic partners (if there is a trade agreement).

You Might Also Enjoy: Which Fabric Is Best for Reception Furniture? – 2026 Review

Specific office‑furniture-related tariffs

The office furniture industry has been particularly affected by a combination of several types of tariffs:

1. Chinese imports

- Ready-made furniture, semi-finished parts, frames, and metal fittings are all subject to tariffs of between 25% and 50%.

- China has had the greatest impact, as the main supplier of more than 30% of US furniture imports.

2. Canada/Mexico materials

- Wood, particleboard, industrial fabrics, and even foam are imported from these countries.

- New tariffs on these materials have increased the cost of production in the United States.

3. steel/aluminum inputs

- Tariffs on imported metals used in key components of office chairs, desks, and office cabinets have led to a direct increase in the final price of the product.

- Domestic producers are also forced to purchase these metals at higher prices.

The Specific Impact of Tariffs on Office Furniture

Why is the office furniture industry particularly vulnerable to tariffs?

This vulnerability is due to structural and supply chain reasons for this industry, as it is heavily dependent on imported raw materials and manufactured goods.

- Increased Raw Material Costs: Many companies operating in this field import raw materials such as wood, metal, fabric, foam, and other specialized parts from countries such as China, Canada, Mexico, and Vietnam.

The imposition of high tariffs on these materials has caused a significant increase in the cost of production, even for those producers who operate domestically.

- Higher Prices for Finished Goods: On the other hand, a large portion of office furniture is imported from abroad as finished and ready-made products.

This includes desks, chairs, filing cabinets, and other types of office equipment, the prices of which have increased by between 20 and 40 percent due to the new tariffs.

- Projecting Your Project Budget: This price increase has not only put a strain on project budgets, but also, due to limited domestic production capacity, there is no immediate opportunity for replacement.

In addition to these factors, office furniture projects are usually carried out on a large scale and require precise scheduling, a specific budget, and price stability.

The sudden increase in the cost of tariffs on office furniture has disrupted this balance and forced companies to reconsider their project planning and budgeting.

As a result, the combination of import dependence and severe price volatility has made the industry particularly vulnerable to tariff changes.

You Might Also Enjoy: Top 10 Office Furniture Trends for 2026

Strategic Solutions to Mitigate the Cost of Tariffs on Office Furniture

The increase in tariffs in 2026 has caused companies and administrative project managers to seek practical and effective strategies for controlling costs and managing risk.

Early purchase and use of tax incentives, such as IRS Section 179, can have significant financial impacts in reducing the final costs of the project.

Below are some key approaches to dealing with this crisis:

1. Diversifying Your Supply Chain

One of the most important steps that many companies have taken is to gradually move out of supply chains in high-tariff countries—like China—and toward countries with lower tariffs.

Southeast Asian countries such as Vietnam, Malaysia, and Thailand, as well as some European and South American countries, have been introduced as alternative destinations.

There has also been a lot of attention given to a concept called “nearshoring,” which is the transfer of production to neighboring countries like Mexico or even production within the United States.

This measure, while reducing tariff costs, also reduces supply chain risk and shipping delays.

2. Pre‑Purchase Strategies

Some companies have avoided cost increases by purchasing inventory before tariffs increase (Pre-Tariff Stock).

If you can shop before the new tariffs go into effect, you will effectively avoid paying a 25% increase in costs on some product groups, such as imported office furniture.

This decision can save thousands of dollars on large projects.

3. Procurement Legal and Tax Tactics

Companies can reduce the basis for calculating the cost of tariffs on office furniture by using the “First Sale Rule.”

This rule allows companies to pay tariffs based on the initial price of the first seller in the chain, rather than the final price of the product.

Also, revision of customs classification codes (HS Codes) can lead to lower tariffs or exemptions if the goods are placed in a different category.

Under Section 179 of the U.S. federal tax code, businesses can deduct the entire purchase price of equipment and furniture from their taxable income in the same fiscal year.

This law is designed to encourage investment in work equipment and technology, and includes office furniture, software, and machinery.

Although large companies also benefit from this law, it is small and medium-sized businesses that benefit the most.

You Might Also Enjoy: How to Measure an Office Space for Furniture?

4. Buying New or Used Equipment

One of the key advantages of Section 179 is that it covers both new and used equipment.

So even if you have a limited budget, you can still take advantage of these benefits by purchasing refurbished or used furniture.

Or choosing domestically manufactured models at competitive prices has been an effective solution for cost management.

These options are especially useful for projects with limited budgets or tight schedules.

5. Project Timing and Scope Adjustments

Proper timing is another determining factor in cost management during tariff increases.

Pre-ordering and ordering early can prevent you from facing higher tariff rates in the future.

If you know your company or project will need more office furniture and equipment in the near future, it is better to buy more than you currently need and keep it in stock.

Also, prioritizing project phasing, gradual implementation, or using simpler models (for example, removing electric motors from standing desks) are practical solutions to maintain a balance between quality and cost.

6. Leveraging Technology and Data

Employing digital tools can help companies manage the impact of the cost of tariffs on office furniture in real time.

Inventory and supply chain management software allows real-time tracking of prices and the impact of tariffs.

Also, by using data analysis and predictive algorithms, it is possible to predict and plan the appropriate time to buy, order volume, and possible market changes.

This level of awareness can save significant time and money.

7. Supplier Negotiation and Absorption Tactics

In response to the sharp increase in tariffs in 2026, many importers and manufacturers are looking to change their pricing strategy.

Some of them are trying to absorb part of the costs caused by the tariff themselves so that demand does not disappear and they retain large customers.

This presents a great opportunity for B2B buyers to be smarter in their negotiations.

For example, an importer facing a 25% tariff increase may be willing to pay 10-15% of the increase themselves and only apply the remaining portion to the final price, provided that you, as the buyer, sign a long-term contract or commit to a larger purchase volume.

Therefore, reviewing offers from different suppliers will give you more bargaining power.

As a buyer, offer to cover a percentage of the new tariff costs yourself, especially if you are already their customer.

Even if the tariff is passed on to you, you can negotiate to split it into multiple invoices.

Ultimately, companies that negotiate transparently, quickly, and professionally with their suppliers can alleviate some of the pressure from tariffs and implement their office furnishing projects with significant savings.

You Might Also Enjoy: Where to Donate Office Furniture in Houston [2026 Guide]

The Hidden Costs: Beyond the Sticker Price

Supply Chain Disruptions

- Increased delivery times due to stricter customs controls.

- Disruption to project schedules and incurring additional costs (temporary lease, downtime).

Reduced Product Choice and Availability

- Some models are discontinued due to supply chain changes.

- Limited design and customization options for projects.

- Difficulty finding alternatives for raw materials or specific goods.

Administrative and Operational Burdens

- Complexity in customs documentation, tariff classification, and regulatory compliance.

- Double pressure on finance, legal, and commercial teams.

Conclusion

In 2026, the impact of tariffs on office furniture projects has gone from a secondary concern to a determining factor in project budgeting, decision-making, and scheduling.

Direct costs, such as rising prices for raw materials and finished products, and more hidden costs, all contribute significantly to the increase in the actual cost of purchasing and implementing office furnishing projects.

Given the increase in the average effective tariff rate, companies are forced to take a more strategic view of their equipment purchases.

This pressure not only affects the final price but also has a direct impact on delivery time, quality, variety, and even the stability of business performance.

If you are thinking about setting up or renovating an office, or have a project to equip offices in 2026, be sure to include tariff costs in calculating the total cost of ownership of the project, not just in the sticker price of the goods.

Also, use smart tactics like diversifying your supply chain, negotiating for supplier tariff absorption, utilizing tax incentives like Section 179, and taking advantage of free trade zones.

Overall, in a market where tariffs have become part of the everyday financial reality of businesses, the real winners are those who make smart decisions, plan flexibly, and execute consciously.

John Ofield is the owner of Collaborative Office Interiors. Houston’s trusted source for modern and commercial office furniture, office cubicles, demountable walls, office desks and tables, and complete workspace solutions. With more than 40 years of experience, he combines deep product knowledge with hands-on space-planning expertise to create ergonomic, productivity-focused work environments for businesses across Southeast Texas.